When it comes to choosing between aluminum and stainless steel for your next project, the decision can be complex, given the significant differences in cost and material properties. Are you wondering which metal offers better value for your budget or which one is more suited to specific industries such as aerospace or automotive? This article delves deep into the comparative analysis of aluminum and stainless steel, highlighting key factors like cost, durability, and application suitability. By the end, you’ll have a clear understanding of which material stands out in terms of performance and price, helping you make an informed decision. Ready to uncover the nuances between these two versatile metals? Let’s dive in.

Aluminum and stainless steel are two of the most popular metals in manufacturing and engineering. Each metal has unique properties and advantages that make them suitable for different applications, so understanding their characteristics is crucial for choosing the right material for a project.

Selecting the right material is crucial in engineering and manufacturing, influenced by factors like cost, strength, weight, corrosion resistance, and thermal properties. Engineers and designers must evaluate these factors to ensure optimal performance and cost-efficiency in their projects.

Aluminum, a lightweight metal, is praised for its malleability, excellent thermal conductivity, and resistance to corrosion. It is particularly favored in applications where reducing weight is critical, such as in the aerospace and automotive industries. Its lower density and ease of fabrication contribute to its cost-effectiveness, especially when considering volume-based costs.

Stainless steel, on the other hand, is renowned for its superior strength, durability, and exceptional corrosion resistance. It is often chosen for applications that demand high load-bearing capacity, longevity, and resistance to harsh environments. Although stainless steel typically has a higher upfront cost, its long lifespan and reduced maintenance requirements can lead to lower lifecycle costs.

To choose between aluminum and stainless steel, compare their properties and costs, including tensile strength, density, corrosion resistance, thermal conductivity, and ease of fabrication. Each property plays a significant role in determining the suitability of the metal for specific applications.

Both metals find extensive use across various industries, including aerospace, automotive, construction, and more. The choice between aluminum and stainless steel often hinges on the specific demands of the application, such as weight reduction, strength requirements, and environmental conditions.

Understanding the nuanced differences between aluminum and stainless steel helps engineers and designers make decisions that align with performance criteria and budget constraints, ensuring the success of their projects.

Understanding the cost dynamics of aluminum and stainless steel requires a look at their market prices and the factors influencing these costs.

Aluminum is generally less expensive per kilogram than stainless steel, and its lower density translates to less weight for the same volume, making it a cost-effective choice in weight-sensitive applications.

Although more expensive per kilogram, stainless steel offers superior strength and corrosion resistance. The cost is driven by expensive alloying elements like chromium and nickel, which also contribute to its durability and longevity.

Aluminum’s lower density means that for a given weight, you get more volume. This can result in higher costs per kilogram when more material is needed to achieve the same strength as stainless steel.

By volume, aluminum can be more cost-effective since less material weight is needed for the same size. This makes aluminum advantageous in applications where reducing weight is crucial, such as in the automotive and aerospace industries.

Stainless steel is preferred for its durability and corrosion resistance in harsh environments, such as marine and construction applications. Despite higher material costs, its long-term performance and lower maintenance can make it more cost-effective over time.

Aluminum’s lower weight and excellent electrical conductivity make it ideal for power lines, vehicles, and aircraft. The reduced structural weight can lead to improved fuel efficiency and performance in vehicles and aircraft, as well as easier installation and maintenance of power lines.

Aluminum’s better thermal conductivity and machinability can lower fabrication costs in cooling and electrical applications. On the other hand, stainless steel’s high-temperature tolerance makes it suitable for extreme heat environments.

Aluminum has a density of approximately 2.7 g/cm³. This makes aluminum significantly lighter than stainless steel, which has a density between 7.9 and 8.0 g/cm³. Consequently, aluminum components usually weigh about one-third of similar stainless steel components, a critical factor in industries prioritizing weight reduction.

Stainless steel generally offers superior tensile strength, ranging from 515 MPa to 1300 MPa, compared to aluminum’s 100 MPa to 400 MPa. This means stainless steel can handle greater pulling forces, making it ideal for high-stress applications.

Stainless steel has a melting point between 1400°C and 1450°C, whereas aluminum melts at around 660°C. Stainless steel’s high melting point makes it better suited for high-temperature applications where aluminum might deform or melt.

Both aluminum and stainless steel are corrosion-resistant. However, stainless steel has an edge in harsh environments. It forms a chromium oxide layer that provides excellent protection. Although aluminum forms a protective oxide layer, it may not be as effective in highly acidic or alkaline environments.

Aluminum is a far better thermal conductor, with a thermal conductivity ranging from 205 – 235 W/mK. In contrast, stainless steel has a thermal conductivity of only 15 – 25 W/mK. This property makes aluminum ideal for heat transfer applications such as heat exchangers.

Aluminum has higher electrical conductivity than stainless steel. This makes it beneficial for electrical wiring and components, where efficient electrical conduction is required.

Aluminum provides a favorable strength-to-weight ratio. This characteristic makes it highly suitable for aerospace and automotive applications, where reducing weight while maintaining adequate strength is critical.

Stainless steel is generally harder, with a hardness ranging from 80 – 600 HB, compared to aluminum’s hardness of about 15 HB. This greater hardness gives stainless steel better durability in wear-intensive applications.

Aluminum is much lighter than stainless steel, with a density of 2.7 g/cm³ compared to stainless steel’s 7.9–8.0 g/cm³. This lower density is crucial for applications where weight reduction is a priority, such as in aerospace and automotive industries.

Aluminum’s tensile strength varies between 90 and 570 MPa, depending on the alloy and treatment. In contrast, stainless steel offers a tensile strength between 515 and 1300 MPa, making it generally much stronger. This superior strength makes stainless steel suitable for high – stress applications requiring greater load – bearing capacity.

Stainless steel also outperforms aluminum in yield strength, meaning it can withstand higher loads without permanent deformation. This property makes stainless steel ideal for heavy structural applications where durability and load capacity are critical.

With a hardness of about 15 HB, aluminum is softer and more prone to scratches and dents. Stainless steel, however, ranges from 80 to 600 HB, offering greater hardness and wear resistance, which is beneficial in applications exposed to abrasive conditions.

Aluminum is highly malleable and ductile, making it easier to form and shape into complex geometries. Stainless steel, while less malleable, still offers good formability, particularly in austenitic grades, which can be advantageous for certain manufacturing processes.

Aluminum boasts a high strength – to – weight ratio, which is advantageous for creating lightweight yet strong components. While stainless steel has a lower strength – to – weight ratio, its absolute strength is higher, making it suitable for applications where maximum strength is needed.

Aluminum forms a natural oxide layer that provides good corrosion resistance and prevents rusting. However, it is more susceptible to corrosion in highly acidic, alkaline, or marine environments unless treated or alloyed for enhanced protection.

Stainless steel contains chromium, which forms a stable chromium oxide film that offers superior corrosion resistance across a wide range of environments, including acidic, alkaline, and marine conditions. This makes stainless steel more durable and maintenance – free in harsh environments.

Aluminum’s high thermal conductivity (205 – 235 W/mK) makes it ideal for heat dissipation in heat sinks and radiators, whereas stainless steel’s lower conductivity (15 – 25 W/mK) limits its use in such applications.

Aluminum also has higher electrical conductivity, which is beneficial for electrical wiring and components where efficient electrical conduction is required. Stainless steel’s lower electrical conductivity makes it less suitable for such applications.

Aluminum has a melting point of around 660°C, whereas stainless steel melts at a significantly higher temperature, between 1400 and 1450°C. Stainless steel’s high melting point allows it to maintain strength and structural integrity in high – temperature applications, such as exhaust systems and heat exchangers.

Aluminum softens at temperatures around 400°C, limiting its use in high – heat environments. Stainless steel, however, can maintain its mechanical properties at much higher temperatures, making it suitable for applications involving prolonged exposure to high heat.

Aluminum is easier to machine, cut, bend, and form due to its lower strength and higher malleability. This allows for complex shaping with less effort and tooling wear. On the other hand, stainless steel requires more force and specialized equipment for fabrication, although certain grades, such as austenitic stainless steels, offer improved formability.

Aluminum’s lower density means it weighs about one – third of stainless steel for the same volume. This significant weight difference is crucial in industries where reducing weight can lead to improved performance and efficiency, such as in aerospace, automotive, and portable consumer goods. The lower weight also facilitates easier handling and transportation.

Aluminum is cheaper due to its abundance and simpler production, but its lower strength means more material is needed, potentially increasing costs per unit weight. Stainless steel, while more expensive due to higher material costs and complex manufacturing processes, offers longer service life and lower maintenance costs in corrosive or high – stress environments.

Aluminum is extensively used in the aerospace industry due to its high strength-to-weight ratio, corrosion resistance, and ease of fabrication. Critical components like aircraft fuselages, wings, and structural frames benefit from aluminum’s lightweight nature, which greatly enhances fuel efficiency and overall performance.

Stainless steel is ideal for landing gear, exhaust systems, and fasteners because it can endure high stress and extreme temperatures. Its high strength, durability, and heat resistance make it invaluable in these critical components. Non-magnetic stainless alloys are also utilized in specific aerospace applications requiring special properties.

Aluminum is favored in the automotive industry for body panels, engine blocks, transmission cases, and wheels due to its lightweight properties. Lighter vehicles benefit from improved fuel efficiency and better performance. Additionally, aluminum’s thermal conductivity is beneficial for radiators and heat exchangers, while its malleability allows for intricate designs in automotive parts.

Stainless steel is used in automotive applications where strength and durability are critical. Components such as exhaust systems, structural parts, and safety features benefit from stainless steel’s high tensile strength and corrosion resistance. Its ability to withstand high temperatures makes it ideal for exhaust systems and engine components exposed to extreme heat.

In the construction industry, aluminum is used for window frames, façade panels, roofing systems, and structural elements due to its corrosion resistance, lightweight nature, and ease of forming. Aluminum’s ability to be extruded into complex shapes allows for innovative architectural designs, while its durability ensures longevity with minimal maintenance.

In construction, stainless steel is preferred for load-bearing structures, reinforcing bars, and architectural elements that face harsh environments. Its superior strength and corrosion resistance make it ideal for bridges, high-rise buildings, and coastal structures. Stainless steel’s aesthetic appeal and durability also make it a preferred choice for decorative and functional elements in construction.

In the medical and food industries, stainless steel is favored for its non-reactive, hygienic, and easily sterilizable properties. Surgical instruments, medical devices, and food processing equipment benefit from stainless steel’s corrosion resistance and durability. Its ability to withstand repeated sterilization processes without degradation is crucial in these sectors.

Aluminum is used in some lightweight medical devices and cookware, favored for its thermal conductivity and weight advantages. However, it is less common in applications requiring frequent sterilization and high corrosion resistance, where stainless steel is preferred.

Aluminum is highly favored for electrical wiring, heat sinks, radiators, and HVAC components due to its excellent electrical and thermal conductivity combined with light weight. Its ability to efficiently conduct heat and electricity makes it indispensable in applications requiring effective heat dissipation and electrical performance.

Stainless steel is less conductive but preferred in applications requiring thermal insulation or where heat resistance is necessary. Components in high-temperature industrial processing and environments needing robust thermal barriers often utilize stainless steel for its durability and heat tolerance.

Stainless steel is preferred in marine and chemical processing industries due to its superior corrosion resistance in saltwater and chemically aggressive environments. This ensures long-term durability and low maintenance, making it ideal for marine structures, chemical tanks, and processing equipment exposed to harsh conditions.

Aluminum is used in less aggressive marine environments or where weight savings are critical. While it provides good corrosion resistance, it is generally less durable under heavy corrosion conditions compared to stainless steel. Its lightweight nature is beneficial for marine applications requiring buoyancy and fuel efficiency.

Both aluminum and stainless steel are crucial in the circular economy because they are highly recyclable and offer sustainability benefits.

Aluminum is highly recyclable, with recycling processes saving up to 95% of the energy required for primary production. This energy savings makes aluminum recycling both economical and environmentally friendly, and aluminum can be recycled indefinitely without losing its quality. This capability supports a closed-loop recycling system, reducing the need for new raw material extraction and minimizing environmental impact. Additionally, aluminum’s lightweight nature reduces energy consumption during transportation, further lowering its lifecycle emissions.

Stainless steel also excels in recyclability, with efficient recycling processes facilitated by its magnetic properties, which allow for easy separation from waste streams. This metal is known for its durability and long lifespan, which contributes to sustainability by reducing the frequency of replacements. Electric arc furnaces (EAF) in stainless steel production enable more recycled content use, which significantly lowers the carbon footprint of the process. Stainless steel’s durability and long life mean products last longer, reducing waste and resource use.

The production processes of aluminum and stainless steel have distinct environmental footprints.

Aluminum production uses a lot of energy, mainly because of the smelting process needed to extract it from bauxite ore. However, the industry is increasingly adopting renewable energy sources to mitigate the high initial energy costs associated with aluminum production. Aluminum’s natural corrosion resistance reduces the need for additional protective coatings, thereby decreasing chemical waste and environmental pollution.

The production of stainless steel involves significant resource intensity due to the mining and alloying of elements such as chromium and nickel. These processes contribute to stainless steel’s higher carbon footprint compared to aluminum. However, innovations in the industry, such as the development of hydrogen-based, fossil-free steel production, are set to reduce the environmental impact. Despite these advancements, the use of traditional blast furnaces, which are heavily reliant on coal, remains a major contributor to global CO₂ emissions.

The cost dynamics of aluminum and stainless steel are influenced by their production and operational efficiencies.

Recycled aluminum is often more cost-competitive than virgin material due to the lower energy requirements of the recycling process. The lightweight nature of aluminum reduces transportation costs, leading to operational savings and lower carbon emissions.

While stainless steel has higher initial production costs, these are offset by its durability and recyclability. The material’s superior corrosion resistance reduces long-term maintenance and replacement costs, making it economically viable in harsh environments over the long term.

Both aluminum and stainless steel offer unique properties that influence their applications and sustainability profiles.

| Property | Aluminum | Stainless Steel |

|---|---|---|

| Weight | Approximately one-third the weight of steel | Heavier, increasing transport costs |

| Corrosion Resistance | Naturally forms a protective oxide layer | Superior resistance due to chromium content |

| Thermal Conductivity | High, making it ideal for heat exchangers | Lower, suitable for high-temperature stability |

| Malleability | Easily shaped into complex designs | Requires specialized forming tools |

Aluminum is increasingly favored in industries such as packaging and electric vehicles (EVs) due to its lightweight properties. The demand for sustainable packaging solutions and the automotive industry’s focus on reducing vehicle weight to improve fuel efficiency and reduce emissions drive the use of aluminum.

Stainless steel dominates in sectors like medical, food processing, and construction due to its hygienic properties and longevity. Its ability to withstand harsh conditions without degrading makes it a sustainable choice for applications requiring durability and cleanliness.

The future trends for aluminum and stainless steel are shaped by ongoing advancements in sustainability practices.

The demand for aluminum in circular packaging solutions is rising as consumers increasingly prioritize transparency and sustainability. This trend underscores the importance of aluminum in achieving closed-loop recycling and reducing environmental impact.

The stainless steel industry is moving towards decarbonization with the adoption of hydrogen-based production methods and increased use of electric arc furnaces. These initiatives aim to significantly reduce the carbon footprint of stainless steel manufacturing by 2030, aligning with global sustainability goals.

Aluminum scrap prices show variability depending on the type. For instance, California Refund Value (CRV) aluminum cans usually fetch around $0.60 per pound, while other forms such as aluminum machine cuts and grills range from $0.28 to $0.45 per pound. The recycling process of aluminum is highly energy-efficient and cost-effective compared to primary production. Recycling aluminum saves approximately 95% of the energy required to produce new aluminum, significantly reducing greenhouse gas emissions and conserving natural resources.

Stainless steel scrap prices vary significantly based on grade and cleanliness. Non-magnetic stainless steel scrap is priced around $0.36 per pound, and 316 stainless steel scrap can reach as high as $0.55 per pound. The recycling process of stainless steel is more complex because it involves sorting different grades and removing contaminants. This complexity requires specialized facilities and processes, which can lead to increased costs.

Global market demand significantly impacts the prices of both materials. Aluminum experiences consistent demand due to its extensive use in packaging and transportation sectors, while stainless steel demand fluctuates according to industrial and construction activities.

Both aluminum and stainless steel benefit from being clean and well-segregated, which reduces processing costs and enhances their value to recyclers. Poor-quality or mixed scrap can lead to a significant reduction in value for both materials. For instance, mixed scrap requires additional sorting and cleaning, which increases labor and operational costs,

Recycling aluminum and stainless steel conserves natural resources and reduces greenhouse gas emissions. However, aluminum recycling is particularly noteworthy for its substantial energy savings. The process of recycling aluminum consumes only 5% of the energy needed for primary production, translating into fewer emissions and a smaller carbon footprint. This makes aluminum recycling an especially environmentally friendly option.

Below are answers to some frequently asked questions:

The main differences in cost between aluminum and stainless steel are influenced by their material properties, production processes, and application demands.

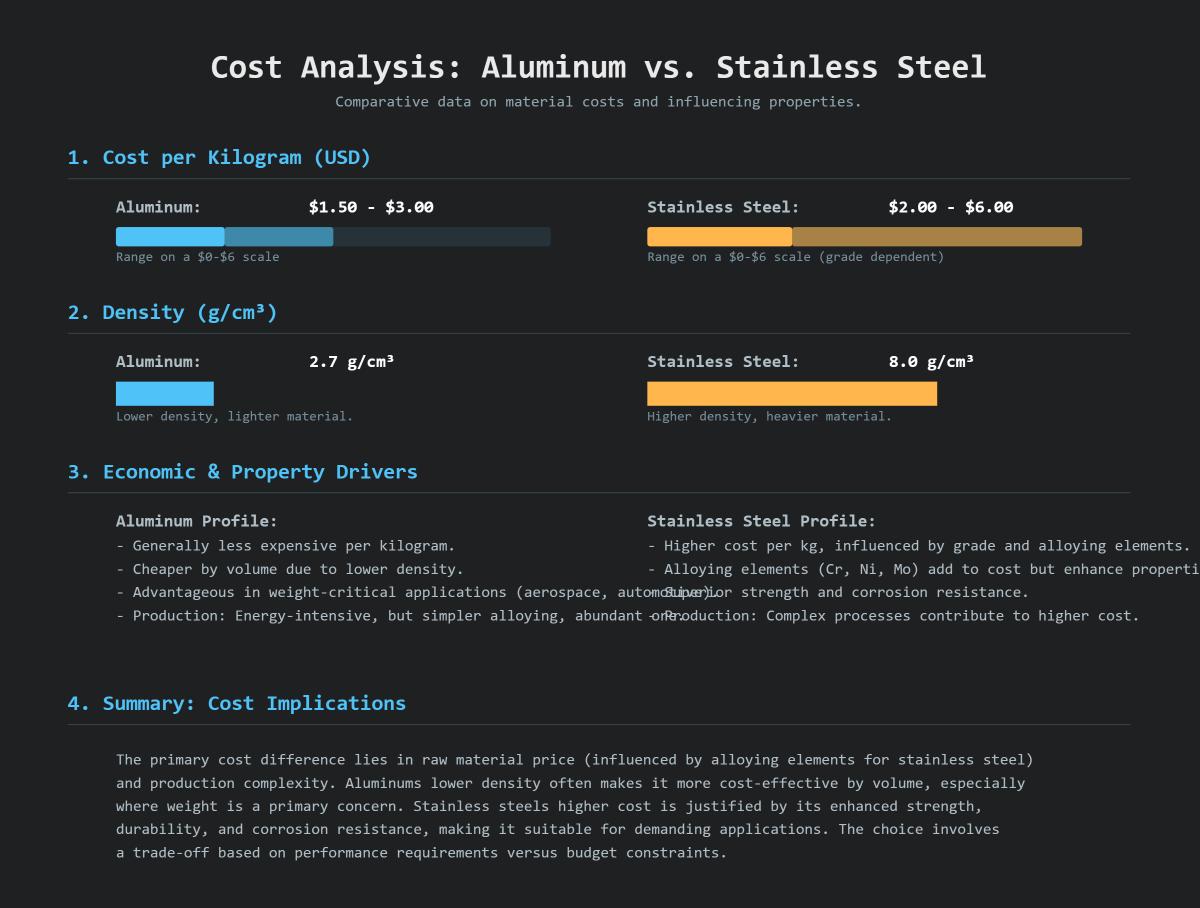

Aluminum is generally less expensive per kilogram, with prices typically ranging from $1.50 to $3.00. In contrast, stainless steel costs between $2.00 and $6.00 per kilogram, depending on the grade and alloying elements. Higher-grade stainless steels containing chromium, nickel, and molybdenum are more costly due to the price of these alloying elements.

Aluminum’s lower density (2.7 g/cm³) compared to stainless steel (8.0 g/cm³) means that it is cheaper by volume, which is advantageous in applications where weight is a critical factor, such as aerospace and automotive industries. However, when comparing by weight, aluminum can be more expensive because more volume is needed to achieve the same strength as stainless steel.

Stainless steel’s higher cost is primarily driven by the expensive alloying metals and complex production processes, which enhance its corrosion resistance and strength. On the other hand, aluminum production, although energy-intensive, benefits from simpler alloying requirements and the abundance of aluminum ore, keeping its cost relatively lower compared to stainless steel.

Aluminum is preferred over stainless steel in several industries. In aerospace, its high strength-to-weight ratio is crucial for aircraft bodies and non-critical components. The automotive industry uses aluminum for body panels and engine parts to reduce weight and improve fuel economy. It’s also favored in electrical and heat transfer applications due to its superior conductivity. In construction, aluminum is used for architectural features like window frames because of its malleability and light weight. Additionally, it’s popular in consumer goods, medical devices where weight reduction matters, and limited marine applications with corrosion-resistant alloys.

When comparing the material properties of aluminum and stainless steel, several key differences emerge. Stainless steel has significantly higher tensile, yield strength, and hardness, making it ideal for load – bearing and high – wear applications. However, aluminum is more ductile and malleable, allowing for easier forming. In terms of weight, aluminum is about one – third the weight of stainless steel, with a density of approximately 2.7 g/cm³ compared to 7.9 – 8.0 g/cm³ for stainless steel. Stainless steel has excellent corrosion resistance in various environments, while aluminum offers good resistance but can be compromised in harsh conditions. Aluminum has high thermal and electrical conductivity, making it suitable for heat – dissipation and electrical applications, but it has a lower melting point than stainless steel.

When comparing aluminum and stainless steel in terms of sustainability, several factors are crucial: recyclability, energy consumption, durability, and environmental impact.

Aluminum is highly recyclable and requires only about 5% of the energy needed to produce it from raw materials, making it exceptionally energy-efficient during recycling. However, its initial production is energy-intensive and often relies on non-renewable energy sources, though the use of renewable energy is increasing. The extraction of bauxite, its primary ore, can lead to environmental issues like deforestation and pollution.

Stainless steel, while also highly recyclable, requires more energy for recycling compared to aluminum. Its production involves mining iron ore, nickel, and chromium, which can lead to habitat destruction and greenhouse gas emissions. Despite these initial environmental costs, stainless steel’s durability means it has a longer lifespan, reducing the need for frequent replacements and thus lowering its overall environmental impact over time.

When choosing between aluminum and stainless steel for a project, several factors need to be considered:

By balancing these factors—cost, mechanical properties, corrosion resistance, weight, and fabrication needs—you can select the most suitable material for your specific project requirements.

Recycling costs for aluminum are generally lower compared to stainless steel due to several factors. Aluminum has higher scrap value, typically ranging from $0.60 to $1.00 per pound, and requires only about 5% of the energy needed for primary production, making it highly cost-effective. The simpler melting process and fewer alloy variants also contribute to lower operational costs.

Stainless steel, on the other hand, has lower scrap value, averaging $0.36 to $0.55 per pound, and involves more complex sorting and higher energy requirements due to the variety of grades and alloying elements. These factors increase processing costs. Additionally, stainless steel’s higher density leads to greater transportation costs per unit weight.

Overall, aluminum recycling is more cost-effective due to higher scrap prices, lower energy consumption, and simpler processing, whereas stainless steel recycling, though economically viable, incurs higher sorting and energy costs.